Financial Strategy

Language switcher

Increasing corporate value through continued growth investments

Building on the culmination over five years in the final year of our Long-Term Management Objectives toward the next leap forward

Director & Vice President

In charge of Group Auditing, Group Finance & Accounting,

and Group Procurement

Chief Executive of Finance & Accounting Headquarters

Tsuyoshi Osato

Achieved Long-Term Management Objectives (2021–2025) Ahead of Schedule and Posted Record-High Profit for the Fourth Consecutive Year

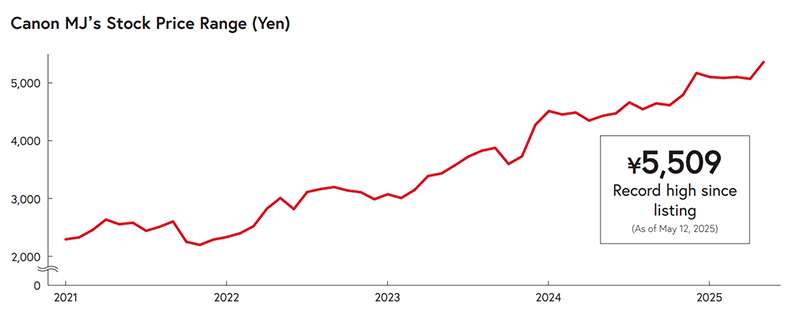

Overview of Business

For the year ended December 31, 2024, we achieved record high profits for the fourth year in a row, with net sales of ¥653.9 billion (up 7% year on year), operating income of ¥53.1 billion (up 1% year on year), and net income of ¥39.3 billion (up 8% year on year). As a result, we achieved the initial targets of our Long-Term Management Objectives (2021-2025) one year ahead of schedule. Following our financial results announcement in January, our stock price reached a record high since listing, which we believe reflects strong stakeholder support for the direction of our Groupʼs transformation.

Our strong performance has been driven primarily by the IT solutions business. By delivering optimized solutions tailored to the diverse needs of different customer segments, we have steadily expanded this growth area. As a result, net sales in the segment reached ¥314.6 billion (up 17% year on year) and its share of total Group sales increased from 44% to 48%. Meanwhile, our Canon products business, which includes a high proportion of recurring business revenue, continues to serve as a stable source of revenue for the Group. In addition, by expanding the share of maintenance, operations, and outsourcing services within the IT solutions business, we are enhancing our recurring revenue business and strengthening a structure capable of generating sustainable profits.

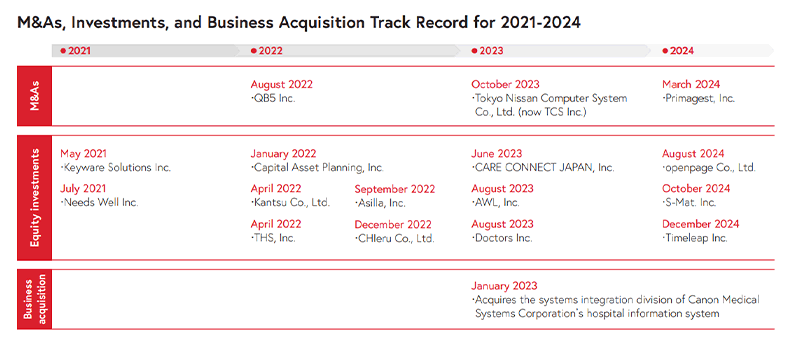

Progress of the Investment Strategy

We have committed to executing growth investments exceeding ¥200.0 billion by 2025 to drive business growth. As of 2024, we have achieved approximately 70% of this target. Within the three investment areas of business investments, investments in human resources, and system investments, the business investments during the four years from 2021 to 2024 include three M&A deals, investments in 13 companies, and one business acquisition. All these investments have been made in the IT solutions business domain, targeting companies in SI-related fields, video solutions, BPO, and other areas where our Group’s assets can be effectively leveraged. We will continue to actively invest in these areas critical for our growth going forward.

An example of advance investment bearing fruit is the establishment of our data center, which began in 2010. Over more than a decade, the data centers have been nurtured as core hubs supporting customer DX support services and cloud services. Another long-term investment area is our CVC fund. Investments in startups with cutting-edge technologies and business ideas are approached from a backcasting perspective based on future social issues to create new business domains, while also supporting the expansion of existing businesses from a forecasting viewpoint.

Meanwhile, in strengthening and expanding the Groupʼs business portfolio, we reviewed whether we are the best owners of certain subsidiaries. In 2024, we sold one consolidated subsidiary to an external company based on this assessment.

Regarding investments in human resources, we are advancing both developing our internal workforce and recruiting professional personnel externally. Investments in learning and skills enhancement for existing employees will continue.

We also conduct training programs for selected managers who are expected to take on future leadership roles. This year-long program, targeted at around a dozen managers and general managers, thoroughly covers corporate management principles and focuses on developing people skills.

Regarding system investments, we are implementing a Business Process Innovation Project. This project aims to build business processes and renew mission-critical systems that can adapt to environmental changes and business transformation, thereby achieving higher productivity.

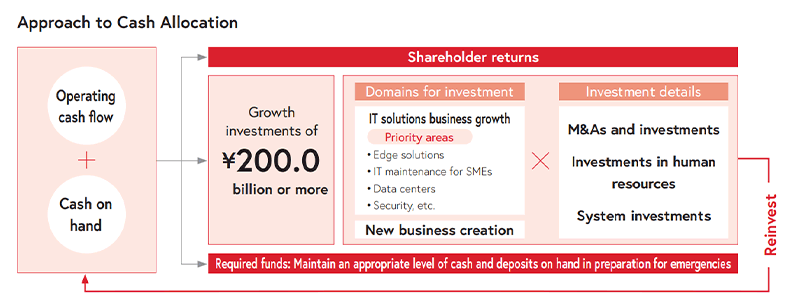

Maintaining Growth Investment and Shareholder Returns While Securing Cash on Hand

Cash Allocation

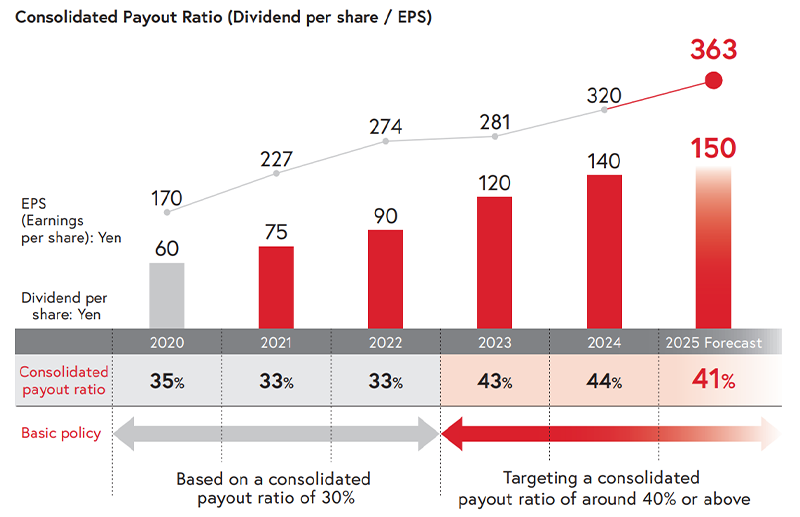

While steadily executing growth investments of approximately ¥200.0 billion by 2025, we continue to provide ongoing and stable shareholder returns and maintain sufficient cash on hand. During the five years from 2021 through 2025, we expect to generate approximately ¥200.0 billion in operating cash flow and distribute a cumulative total of approximately ¥70.0 billion in dividends. Beginning with fiscal 2023, we raised our target consolidated dividend payout ratio to around 40% or above and have continued dividend payments in line with this target.

In addition, we repurchased approximately ¥85.0 billion in treasury stock through two buybacks last year. This share buyback initiative is a category of cash allocation separate from growth investment and shareholder returns, and is aimed at enhancing corporate value by improving capital efficiency. As a result, all key financial indicators improved, with EPS reaching ¥320, ROE at 9.6%, and PBR of 1.5 times. Additionally, we promptly cancelled all repurchased treasury stocks, which reduced the total number of outstanding shares and raised the ratio of outstanding shares, a long-standing capital policy issue, from approximately 38% to around 45%.

Management with an Awareness of Cost of Capital

Our estimated capital cost is approximately 5-6%, as calculated using the Capital Asset Pricing Model (CAPM). However, based on our dialogue with shareholders and investors, we recognize that market expectations exceed this level. We have set an ROE target of 10.0% to be achieved by 2025. We are committed to raising ROE by growing operating revenue and advancing management with an awareness of capital efficiency at the same time, thereby widening the equity spread.

Achieving this will require not only improvements in ROE, but also reductions in our cost of capital. To this end, we recognize the importance of enhanced disclosure. We will provide more transparent explanations: on the business front, regarding the initiatives that have enabled us to achieve increases in both revenue and profit for four consecutive fiscal years; and, on the governance front, regarding how we maintain independence from our parent company despite being part of a parent-subsidiary listing structure. As of March 31, 2025, we had fully collected the ¥50.0 billion loan receivable from our parent company that remained on our books at the end of the previous year. These funds will be redirected to support growth investments by our Group.

With regard to cross-shareholdings, we will accelerate our efforts to reduce such holdings. Meanwhile, when a company holding our shares as part of a cross-shareholding arrangement expresses intent to divest, we will support such action. Funds generated from the reduction of cross-shareholdings will be redirected to growth investments. At the same time, we will strive to reduce capital costs and enhance disclosures, ultimately contributing to stock price appreciation.

Shifting to Non-current Assets That Generate Strong Cash Flows

The ideal business model for the Canon MJ Group is one that pursues growth by developing and expanding a service-type business model within its IT solutions business. Combined with our existing Canon products business, we aim to build a stable recurring revenue base, thereby enhancing overall profitability. As a result, our earning power will improve and fresh cash will be generated, which we can redirect to even more growth investments and non-current assets that generate cash efficiently, creating a virtuous cycle. Key investments include the renewal of our mission-critical systems and investments in software that supports the transformation to a service-type business model. By horizontally expanding industry-specific solution services across similar industries, and vertically tailoring them for companies of different sizes, we are building a strong foundation for the recurring revenue business through an efficient development framework.

As we continue to actively pursue M&A, M&As with companies with strong excess earning power may lead to the recognition of substantial goodwill and customer-related assets, along with an increase in associated amortization expenses. Rather than taking a short-term view, we will base our investment decisions on a forward-looking assessment of medium- to long-term synergies. Moreover, our focus with M&As is on post-merger integration (PMI). To enhance the corporate value and drive further growth of both the acquired companies and the Group as a whole, we believe it is essential to go beyond merely integrating management foundations and to continue actively generating synergies. We are placing particular emphasis on PMI activities for TCS and Primagest, which have recently joined the Group.

To Our Stakeholders

As of the end of 2024, the Canon MJ Group maintains a robust balance sheet, with an equity ratio of 73% and a current ratio of approximately 270%, indicating a very low level of debt. We will continue to allocate the cash we generate to growth investments and shareholder returns, but we are not aiming to eliminate borrowings entirely.

While we have announced growth investments totaling approximately ¥200.0 billion, if an M&A opportunity arises that cannot be fully funded with cash on hand, we are prepared to make use of borrowing. Even if this leads to a temporary increase in liabilities, we believe it is essential to use leverage for these opportunities without hesitation.

Although we currently maintain an extremely sound and stable balance sheet, we do not intend to preserve it at the expense of future opportunities. We will execute investments decisively when favorable opportunities arise, which will ultimately lead to expanding our equity spread.

With strong performance in our IT solutions business, the Canon MJ Group has achieved revenue and profit growth for four consecutive years. In order to further deepen the marketʼs understanding of the key drivers behind this growth, we recognize the need for clearer and more proactive information disclosure. By expanding our business segment-based disclosure, including highlighting the unique strengths of our IT solutions business, we believe we can further enhance our corporate value. In addition, we will continue working to increase ROE through improved return on capital and profit growth.

The year 2025 will mark the culmination of our efforts over the past four years and represent the final year of our current Long-Term Management Objectives. At the beginning of 2026, we will announce our new approaches and initiatives in our next Long-Term Management Objectives and MediumTerm Management Plan, and we look forward to sharing with you the next stage of our journey.

-

*

The content of this page is based on information at the issuance of the integrated report.