Returns to Shareholders and Dividend

Language switcher

日本語

English

The fundamental view over the Returns to Shareholders

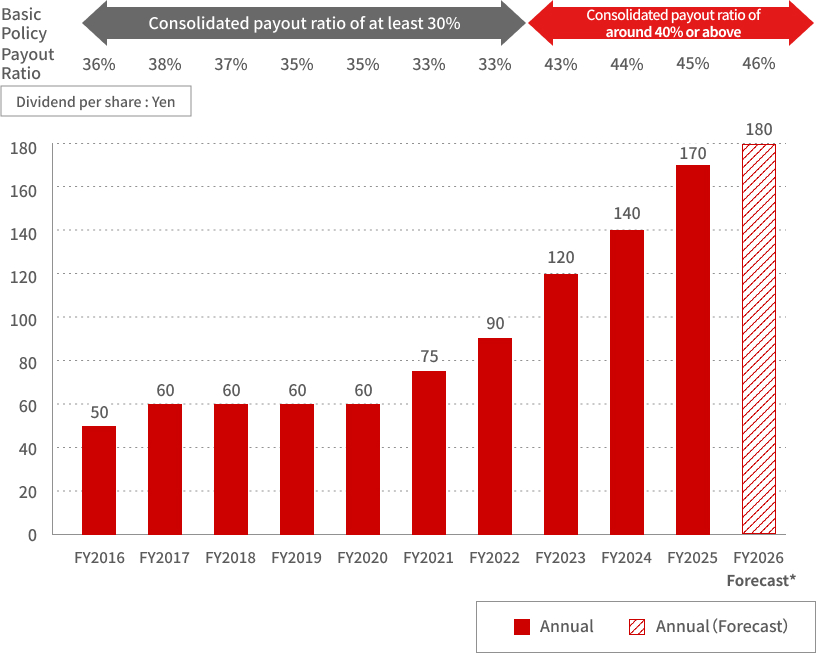

Our basic policy on profit sharing is to pay dividends based on consolidated payout ratio of around 40% or above, comprehensively taking into consideration our medium-term profit forecast, investment plans, and cash flows.

History of our dividend

-

*

The Company has resolved, at the meeting of the Board of Directors held on January 28, 2026, to conduct share split in the proportion of two shares for one share, with the record date set as March 31, 2026 and the effective date set as April 1, 2026. The annual dividend per share for the year ending December 31, 2026 (forecast) represents the amounts stated prior to giving effect to the share split. It should be noted that the annual dividend per share for the year ending December 31, 2026 (forecast) after giving effect to the share split would be 90.00 yen.

-

*

The starting of paying a dividend-interim dividend : Late in August / year-end dividend : Late in March

(Dividend:Yen / Payout Ratio:%)

| Business Term | FY | Interim | Year-end | Annual | Payout Ratio (Full Year) |

|---|---|---|---|---|---|

| 57th | 2025 | 70 | 100 | 170 | 45 |

| 56th | 2024 | 60 | 80 | 140 | 44 |

| 55th | 2023 | 50 | 70 | 120 | 43 |

| 54th | 2022 | 40 | 50 | 90 | 33 |

| 53rd | 2021 | 30 | 45 | 75 | 33 |

| 52nd | 2020 | 20 | 40 | 60 | 35 |

| 51st | 2019 | 30 | 30 | 60 | 35 |

| 50th | 2018 | 25 | 35 | 60 | 37 |

| 49th | 2017 | 25 | 35 | 60 | 38 |

| 48th | 2016 | 20 | 30 | 50 | 36 |

Status of Treasury Stock

| Acquisition period | Means of acquisition | Aggregate number of shares acquired |

Acquisition cost:Yen |

|---|---|---|---|

| October 27, 2025 to December 19, 2025 |

Market purchase in the form of trust | 1,492,800 | 9,999,455,500 |

| July 24, 2025 | Repurchase of shares on the Tokyo Stock Exchange Trading Network Off Auction Own Share Repurchase Trading System (ToSTNeT-3) | 202,700 | 1,066,202,000 |

| December 12, 2024 | Repurchase of shares on the Tokyo Stock Exchange Trading Network Off Auction Own Share Repurchase Trading System (ToSTNeT-3) | 747,500 | 3,718,812,500 |

| July 25, 2024 to August 22, 2024 |

Acquisition through a tender offer | 20,025,320 | 81,923,584,120 |

| November 5, 2013 to December 12, 2013 |

Market purchase in the form of trust | 3,402,900 | 4,999,939,300 |

| October 24, 2012 to December 3, 2012 |

Market purchase in the form of trust | 4,248,200 | 4,999,973,500 |

| November 8, 2010 to December 3, 2010 |

Market purchase in the form of trust | 4,348,500 | 4,999,952,200 |

| October 24, 2008 to November 12, 2008 |

Market purchase in the form of trust | 3,406,100 | 4,999,932,400 |

| August 11, 2008 to September 11, 2008 |

Market purchase in the form of trust | 2,861,300 | 4,999,986,000 |

| February 14, 2008 to March 11, 2008 |

Market purchase in the form of trust | 2,764,700 | 4,999,986,000 |

| October 23, 2007 to November 27, 2007 |

Market purchase in the form of trust | 2,257,200 | 4,999,873,000 |

| August 10, 2007 to September 5, 2007 |

Market purchase in the form of trust | 2,368,300 | 4,999,843,800 |

-

*

The Company cancelled 20,000,000 of its own stock at March 11,2020.

-

*

The Company cancelled 20,000,000 of its own stock at September 30,2024.